The Best Guide To Estate Planning Attorney

The Best Guide To Estate Planning Attorney

Blog Article

The Estate Planning Attorney Diaries

Table of ContentsOur Estate Planning Attorney StatementsAn Unbiased View of Estate Planning AttorneyEstate Planning Attorney for DummiesThe 7-Minute Rule for Estate Planning Attorney

Your attorney will certainly also aid you make your files authorities, scheduling witnesses and notary public signatures as needed, so you don't have to stress over attempting to do that final step on your very own - Estate Planning Attorney. Last, but not least, there is valuable comfort in developing a connection with an estate preparation lawyer who can be there for you later onJust placed, estate preparation attorneys supply value in lots of methods, much beyond simply giving you with published wills, depends on, or various other estate preparing records. If you have inquiries about the procedure and wish to find out more, call our office today.

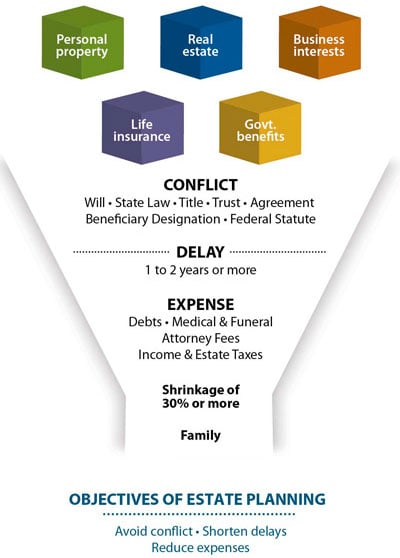

An estate planning attorney helps you formalize end-of-life decisions and legal documents. They can establish wills, establish trusts, produce healthcare directives, establish power of lawyer, produce succession plans, and more, according to your wishes. Dealing with an estate planning attorney to finish and manage this lawful documents can help you in the adhering to 8 areas: Estate planning lawyers are professionals in your state's count on, probate, and tax obligation regulations.

If you do not have a will, the state can make a decision how to separate your properties amongst your heirs, which could not be according to your desires. An estate planning lawyer can help arrange all your lawful files and distribute your properties as you want, potentially staying clear of probate. Many individuals draft estate preparation files and after that ignore them.

The Buzz on Estate Planning Attorney

Once a client passes away, an estate plan would determine the dispersal of properties per the deceased's instructions. Estate Planning Attorney. Without an estate strategy, these choices might be left to the following of kin or the state. Obligations of estate coordinators consist of: Producing a last will and testimony Establishing trust fund accounts Calling an executor and power of attorneys Identifying all beneficiaries Naming a guardian for minor youngsters Paying all debts and minimizing all taxes and legal charges Crafting directions for passing your values Establishing choices for funeral setups Finalizing instructions for treatment if you come to be sick and are not able to make decisions Obtaining life insurance policy, impairment revenue insurance policy, and long-lasting care insurance An excellent estate strategy ought to be updated routinely as clients' economic situations, individual motivations, and federal and state regulations all advance

Similar to any type of profession, there are features and skills that can help you attain these objectives as you work with your customers in an estate coordinator duty. An estate planning profession can be appropriate for you if you have the complying with attributes: Being an estate planner suggests believing in the lengthy term.

Some Known Questions About Estate Planning Attorney.

You must assist your client anticipate his/her end of life and what will occur postmortem, while at the same time not residence on morbid thoughts or feelings. Some clients may come to be bitter or troubled when contemplating fatality and it could be up to you to assist them via it.

In the event of fatality, you might be anticipated to have numerous conversations and ventures with enduring relative concerning the estate plan. In order to stand Recommended Site out as an estate organizer, you might require to stroll a great line of being a shoulder to lean on and the private trusted to communicate estate preparation issues in a timely and specialist manner.

tax obligation code altered thousands of times in the one decade in between 2001 and 2012. Anticipate that it has been modified additionally ever since. Relying on your customer's monetary income brace, which may advance toward end-of-life, you as an estate planner will certainly have to keep your customer's possessions in full legal conformity with any neighborhood, federal, or global tax regulations.

The 30-Second Trick For Estate Planning Attorney

Gaining this certification from companies like the National Institute of Qualified Estate Planners, Inc. can be a strong differentiator. Belonging to these specialist groups can confirm your skills, making you more eye-catching in the eyes of a prospective client. Along with the emotional incentive helpful customers with end-of-life planning, estate organizers take pleasure in the benefits of a secure income.

Estate planning is a smart point to do regardless of your present wellness and financial status. The initial important thing is to employ an estate preparation lawyer to Continue help you with it.

A knowledgeable lawyer understands what info to include in the will, including your beneficiaries and special considerations. It likewise supplies the swiftest and most efficient technique to transfer your assets to your beneficiaries.

Report this page